Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

YETI Holdings, Inc.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11

| | | | |

FiledYETI Holdings, Inc. 7601 Southwest Parkway Austin, Texas 78735

March 26, 2024

DEAR FELLOW STOCKHOLDERS:

We are pleased to invite you to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of YETI Holdings, Inc. (“YETI”) to be held virtually on Tuesday, May 7, 2024, at 8:00 a.m. CDT, at www.virtualshareholdermeeting.com/YETI2024.

There will not be a physical location for the Annual Meeting, and you will not be able to attend the Annual Meeting in person. However, shareholders will be able to listen, vote and submit questions. You will need to provide the 16-digit control number that is on your Notice of Internet Availability of Proxy Materials (the “Notice”) or on your proxy card if you receive materials by mail. Please review the Registrant ý | | Filed by a Party other thaninstructions for virtual attendance included in the Registrant o |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for UseSummary of the Commission Only (as permittedaccompanying Proxy Statement.

The following pages include a formal notice of the Annual Meeting and YETI’s Proxy Statement. These materials describe the Annual Meeting agenda items and other important information about the Annual Meeting. Please read these materials so that you will know what we plan to do at the Annual Meeting.

To support the conservation of natural resources, we have continued to provide access to our proxy materials over the Internet by Rule 14a-6(e)(2)) |

ý |

|

Definitivemailing a Notice to our stockholders who have not previously requested to receive our proxy materials by mail or e-mail. The Notice provides information on how stockholders can obtain paper copies of our proxy materials if they so choose. This method expedites the receipt of your proxy materials, lowers the costs of the Annual Meeting, and supports conservation of natural resources.

It is important that your shares are voted whether or not you plan to virtually attend the Annual Meeting. You can use any of the voting options available to you as described in the accompanying Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

and the Notice or proxy card you received.

We hope you will exercise your rights as a stockholder and fully participate in YETI’s future. On behalf of management and our Board of Directors, we thank you for your continued support of YETI.

Sincerely, Matthew J. Reintjes President and Chief Executive Officer, Director |

| | | | | |

| YETI® 2024 Proxy Statement | i |

| | |

|

YETI Holdings, Inc.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

|

Payment

| | | | | | | | |

DATE Tuesday, May 7, 2024 | TIME 8:00 a.m. CDT | LOCATION www.virtualshareholdermeeting.com/YETI2024 |

| | | | | | | | |

| | |

| YETI’s 2024 Annual Meeting of Filing Fee (CheckStockholders (the “Annual Meeting”) will be held virtually. There will not be a physical location for the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computedAnnual Meeting, and you will not be able to attend the Annual Meeting in person. To be admitted to and participate in the Annual Meeting, you will need to enter the 16-digit control number and follow the instructions on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Titleyour proxy card, voting instruction form, or Notice of each class of securities to which transaction applies:

|

| | (2) | | Aggregate number of securities to which transaction applies:

|

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amountInternet Availability. See additional instructions on which the filing fee is calculated and state how it was determined):

|

| | (4) | | Proposed maximum aggregate value of transaction:

|

| | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any partpage 1 of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing:accompanying proxy statement. | |

|

|

|

(1)

|

Amount Previously Paid:

|

| | (2) | | Form, Schedule or Registration Statement No:

|

| | (3) | | Filing Party:

|

| | (4) | | Date Filed:

|

|

|

|

|

|

| | | | |

| | | | |

| | | | |

Table of Contents

YETI Holdings, Inc.

7601 Southwest Parkway

Austin, Texas 78735

April 4, 2019

To Our Stockholders:

We are pleased to invite you to attend

ITEMS OF BUSINESS

At the Annual Meeting,

of Stockholders of YETI Holdings, Inc. ("YETI") tostockholders will be

held on Friday, May 17, 2019, at 8:00 A.M., local time, at our YETI Flagship store, located at 220 S. Congress Avenue, Austin, Texas 78704.asked to:

| | | | | | | | |

| | |

| 1 | Elect the two Class III director nominees named in the accompanying proxy statement to serve until YETI’s 2027 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified; |

| |

| | | | | | | | |

| | |

| 2 | Approve, by a non-binding advisory vote, the compensation paid to YETI’s named executive officers (a “say-on-pay” vote); |

| |

| | | | | | | | |

| | |

| 3 | Approve the 2024 Equity and Incentive Compensation Plan; |

| |

| | | | | | | | |

| | |

| 4 | Ratify the appointment of PricewaterhouseCoopers LLP as YETI’s independent registered public accounting firm for the fiscal year ending December 28, 2024; and |

| |

| | | | | | | | |

| | |

| 5 | Transact such other business as may properly come before the Annual Meeting or any adjournment(s) or postponement(s) thereof. |

| |

STOCKHOLDERS ENTITLED TO VOTE

The

following pages include a formal notice of the meeting and YETI's proxy statement. These materials describe various matters on the agenda for the meeting and provide details regarding admission to the meeting. Please read these materials so that you will know what we plan to do at the meeting.We have elected to provide access to our proxy materials over the Internet by mailing our stockholders a Notice of Internet Availability of Proxy Materials (the "Notice"). The Notice provides information on how stockholders can obtain paper copies of our proxy materials if they so choose. This method expedites the receipt of your proxy materials, lowers the costs of our annual meeting and supports conservation of natural resources.

It is important that your shares be represented at the meeting, regardless of whether or not you plan to attend the meeting in person. You may vote your shares through any of the voting options available to you as described in the accompanying proxy statement and the Notice or proxy card you received.

We hope you will exercise your rights as a stockholder and fully participate in YETI's future. On behalf of management and our Board of Directors we thank youhas set the close of business on March 12, 2024 as the record date for your continued supportdetermining those stockholders who are entitled to receive notice of, YETI.

Sincerely,

Matthew J. Reintjes

Presidentattend, and Chief Executive Officer, Director

Table of Contents

YETI Holdings, Inc.

7601 Southwest Parkway

Austin, Texas 78735

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of YETI Holdings, Inc.:

The 2019 Annual Meeting of Stockholders (the "Annual Meeting") of YETI Holdings, Inc. ("YETI") will be heldvote at 8:00 A.M., local time, on Friday, May 17, 2019, at our YETI Flagship store, located at 220 S. Congress Avenue, Austin, Texas 78704. The business matters for the Annual Meeting are as follows:

1.The electionor any adjournment(s) or postponement(s) thereof. Only stockholders of the two Class I directors named in the accompanying proxy statement to serve until YETI's 2022 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified; and

2.The ratification, on a non-binding basis, of the appointment of Grant Thornton LLP as YETI's independent registered public accounting firm for the fiscal year ending December 28, 2019.

Stockholders who hold our common stockrecord at the close of business on March 25, 2019the Record Date are entitled to receive notice of, attend, and vote at the Annual Meeting. Whether or not you planA list of stockholders entitled to attend the Annual Meeting, to ensure that your shares are representedvote at the Annual Meeting please vote your shares in one of the manners described in the accompanying materials.

If you plan to attend the Annual Meeting and are a registered stockholder, please bring the Notice of Internet Availability of Proxy Materials that was mailed to you and a valid form of identification. If your shares are registered in the name of a bank or your broker, please bring your bank or brokerage statement showing your beneficial ownership with youwill be available for examination at YETI’s offices for ten days prior to the Annual Meeting or request an invitation by writing to me at YETI Holdings, Inc., 7601 Southwest Parkway, Austin, Texas 78735, Attention: Secretary. In order to vote your shares in person at the Annual Meeting, if you are not a registered stockholder, you must first obtain a valid proxy from the bank or broker that holds your shares.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of

Stockholders to Be Held on May 17, 2019:

Meeting.

| | | | | |

| YETI® 2024 Proxy Statement | iii |

This Notice of Annual Meeting of Stockholders, the accompanying proxy statement and

YETI's2018YETI’s 2023 Annual Report to Stockholders are available at www.proxyvote.com.

The Board of Directors recommends that

YOUR VOTE IS IMPORTANT

Whether or not you

vote "For All"plan to attend the Annual Meeting, you are urged to submit your proxy or voting instructions in one of the

nomineesmanners described in the

electionaccompanying materials as soon as possible so that your shares will be represented and voted in accordance with your wishes and in order that the presence of

twoClass I directors and "For" proposal 2.a quorum may be assured at the Annual Meeting. If you plan to attend the Annual Meeting, please have on hand the control number on your proxy card or Notice of Internet Availability you previously received.

By Order of the Board of Directors,

Bryan C. Barksdale

Senior Vice President, General Counsel

Chief Legal Officer and Secretary

Austin, Texas

April 4, 2019

March 26, 2024

| | | | | |

| iv | YETI® 2024 Proxy Statement |

Table of Contents

2019 PROXY STATEMENT

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement (this “Proxy Statement”) of YETI Holdings, Inc. ("YETI"(“YETI”) contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical or current fact included in this Proxy Statement are forward-looking statements. Forward-looking statements include statements containing words such as “anticipate,” “assume,” “believe,” “can,” “have,” “contemplate,” “continue,” “could,” “design,” “due,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “likely,” “may,” “might,” “objective,” “plan,” “predict,” “project,” “potential,” “seek,” “should,” “target,” “will,” “would,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future performance or other events. For example, all statements made relating to future goals, commitments, programs, and initiatives as well as business performance and strategies are forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that are expected and, therefore, you should not unduly rely on such statements. The risks and uncertainties that could cause actual results to differ materially from those expressed or implied by these forward-looking statements include but are not limited to the risks and uncertainties contained in our filings with the United States Securities and Exchange Commission (the “SEC”), including our Annual Report on Form 10-K for the year ended December 30, 2023, as such filings may be amended, supplemented or superseded from time to time by other reports YETI files with the SEC.

As a result, the actual conduct of our activities, including the development, implementation, or continuation of any program, policy, or initiative discussed or forecasted in this Proxy Statement, may differ materially in the future. As with any projections or estimates, actual results or numbers may vary. The forward-looking statements contained in this Proxy Statement are made based upon detailed assumptions and reflect management’s current expectations and beliefs. While YETI believes that these assumptions underlying the forward-looking statements are reasonable, YETI cautions that it is very difficult to predict the impact of known factors, and it is impossible for YETI to anticipate all factors that could affect actual results. The forward-looking statements included here are made only as of the date hereof. YETI undertakes no obligation to update or revise any forward-looking statement as a result of new information, future events, or otherwise, except as required by law.

WEBSITE REFERENCES

You may also access additional information about YETI at www.YETI.com. References to our website throughout this Proxy Statement are provided for convenience only and the content on our website does not constitute a part of, and shall not be deemed incorporated by reference into, this Proxy Statement.

| | | | | |

| YETI® 2024 Proxy Statement | v |

| | | | | |

| PROXY SUMMARY | |

| |

| OUR BOARD OF DIRECTORS | |

| Proposal 1. Election of Class III Directors | |

| Director Nominees | |

| Class III Directors | |

| Directors Continuing in Office | |

| Class I Directors | |

| Class II Directors | |

| Board Composition, Qualifications, and Diversity | |

| |

| CORPORATE GOVERNANCE | |

| Environmental, Social, and Governance | |

| Director Independence | |

| Board Size and Composition | |

| The Board and Its Committees | |

| Audit Committee | |

| Compensation Committee | |

| Nominating and Governance Committee | |

| Director Nomination Process | |

| Compensation Committee Interlocks and Insider Participation | |

| Board Function, Leadership Structure, and Executive Sessions | |

| The Role of the Board in Succession Planning | |

| The Role of the Board in Risk Oversight | |

| Code of Business Conduct | |

| Board Assessments | |

| Anti-Hedging and Anti-Pledging Policies | |

| Communication with the Board | |

| Non-Employee Director Compensation | |

| Annual Cash Compensation | |

| Equity Compensation | |

| | | | | |

| Company Product Discount | |

| Non-Employee Director Stock Ownership Guidelines | |

| Fiscal 2023 Director Compensation Table | |

| |

| EXECUTIVE COMPENSATION | |

| Proposal 2. Approval, on an Advisory Basis, of the Compensation Paid to Our Named Executive Officers | |

| Executive Officers | |

| Compensation Discussion and Analysis | |

| Executive Summary | |

| Compensation Philosophy and Objectives | |

| Compensation Determination Process | |

| Compensation Program Components | |

| Additional Compensation Policies and Practices | |

| Executive Stock Ownership Guidelines | |

| Clawback Policy | |

| Anti-Hedging and Anti-Pledging Policies | |

| Compensation Committee Report | |

| 2023 Summary Compensation Table | |

| Employment Agreements | |

| Fiscal 2023 Grants of Plan-Based Awards Table | |

| Outstanding Equity Awards at 2023 Fiscal Year-End Table | |

| Equity Compensation Plans | |

| Fiscal 2023 Option Exercises and Stock Vested Table | |

| Post-Termination Compensation | |

| Senior Leadership Severance Benefits Plan | |

| Potential Payments upon Termination or Change of Control | |

| Post-Employment Compensation Table | |

| CEO Pay Ratio | |

| Pay Versus Performance Information | |

| Equity Compensation Plan Information | |

| |

| EQUITY PLAN | |

| Proposal 3. Approval of the 2024 Equity and Incentive Compensation Plan | |

| |

| AUDIT MATTERS | |

| Independent Registered Public Accounting Firm Fees | |

| | | | | |

| Audit Committee Pre-Approval of Audit and Non-Audit Services | |

| Audit Committee Report | |

| Proposal 4. Ratification of Appointment of Independent Registered Public Accounting Firm | |

| |

| STOCK OWNERSHIP | |

| Security Ownership of Certain Beneficial Owners and Management | |

| |

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | |

| Policies and Procedures for Related-Party Transactions | |

| |

| ADDITIONAL INFORMATION | |

| Questions and Answers about the Annual Meeting | |

| Director Nominations and Stockholder Proposals | |

| Annual Report | |

| Other Business | |

| |

| APPENDIX A | |

| 2024 Equity and Incentive Compensation Plan | |

| |

| APPENDIX B | |

| Reconciliation of Non-GAAP Financial Measures | |

This Proxy Statement of YETI is being furnished in connection with the solicitation of proxies by

YETI'sYETI’s Board of Directors (the

"Board"“Board”) for use at

YETI's 2019YETI’s Annual Meeting

of Stockholders (the "Annual Meeting") to be held

on Tuesday, May 7, 2024, at

8:00 A.M., localthe time

and place and for the purpose of voting on

Friday, May 17, 2019, at our YETI Flagship store, located at 220 S. Congress Avenue, Austin, Texas 78704. This proxy statement contains important information regarding the

Annual Meeting. You should review this information, along withmatters set forth in the Notice of Annual Meeting of Stockholders

(the “Annual Meeting Notice”) and

YETI's 2018 Annual Report to Stockholders, before voting.You may vote if you were a stockholder of record at the close of business on March 25, 2019, the record date for the Annual Meeting. Ourany adjournment(s) or postponement(s) thereof. YETI’s proxy materials are first being made available on or about March 26, 2024 to all stockholders entitled to vote at the Annual Meeting.

The summary below highlights certain information contained in this Proxy Statement but does not contain all of the information that you should consider before voting. For more complete information, please review our Annual Report and this entire Proxy Statement.

MATTERS TO BE VOTED ON

The matters to be voted on at the Annual Meeting and the Board voting recommendations for such matters are as set forth below:

| | | | | | | | | | | | | | |

| | | Board Recommendation | Page Reference |

| | | | |

| 1 | The election of the two Class III director nominees named in this Proxy Statement to serve until YETI’s 2027 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified; | FOR | |

| |

| | | | |

| | | | |

| 2 | The approval, by a non-binding advisory vote, of the compensation paid to YETI’s named executive officers; | FOR | |

| |

| | | | |

| | | | |

| 3 | The approval of the 2024 Equity and Incentive Compensation Plan; and | FOR | |

| |

| | | | |

| | | | |

| 4 | The ratification of the appointment of PricewaterhouseCoopers LLP as YETI’s independent registered public accounting firm for the fiscal year ending December 28, 2024. | FOR | |

| |

The stockholders will also transact such other business as may properly come before the Annual Meeting or

about April 4, 2019.

Table of Contents

TABLE OF CONTENTS

any adjournment(s) or postponement(s) thereof. | | | | | | | | |

| | |

| Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting. As permitted by SEC rules, YETI has elected to make the Annual Meeting Notice, this Proxy Statement, and our Annual Report to Stockholders covering YETI’s fiscal year ended December 30, 2023 (our “Annual Report”) available to our stockholders primarily via the Internet at www.proxyvote.com, rather than mailing printed copies of these materials to each stockholder. Each stockholder (other than those who previously requested electronic delivery of all materials or previously elected to receive delivery of a paper copy of the proxy materials) will receive a Notice of Internet Availability of Proxy Materials (the “Proxy Notice”) containing instructions on how to access and review the proxy materials, including the Annual Meeting Notice, this Proxy Statement and the Annual Report, on the Internet and how to access an electronic proxy card to vote on the Internet. If you receive a Proxy Notice by mail and would like to receive a printed copy of our proxy materials, please follow the instructions included in the Proxy Notice to request that a paper copy be mailed to you. | |

| | |

| | | | | |

| YETI® 2024 Proxy Statement | 1 |

HOW TO VOTE

Stockholders of Record

In Advance of the Annual Meeting

If you are a stockholder of record, you can submit a proxy in advance of the Annual Meeting to instruct how to vote your shares at the meeting. You may do this via the following methods:

| | | | | | | | |

| | |

| 1By Mail If you received a printed copy of the proxy materials by mail, complete, sign, date and mail the proxy card in the envelope provided. If you vote via the Internet or by telephone, please do not mail your proxy card. |

|

Director Nominees |

| | | | | | | | |

| | |

|

1By Mobile Device Scan, with your mobile device, the QR code provided on the proxy card mailed to you. |

|

Class I Nominees |

| | | | | | | | |

| | |

|

2By Internet In advance of the Annual Meeting, go to the web address www.proxyvote.com and follow the instructions for Internet voting shown on the Notice of Internet Availability of Proxy Materials or proxy card mailed to you, or the instructions that you received by email. |

|

Class II Directors |

The deadline to submit a proxy in advance by telephone or electronically is 11:59 P.M. EDT on May 6, 2024. If you submit a proxy by phone or electronically for the voting of your shares at the Annual Meeting, you do not need to return a proxy card. If you plan to mail or return a proxy card to instruct how your shares are voted at the Annual Meeting, your proxy card should be returned so that it is received before the polls close at the Annual Meeting.

During the Annual Meeting

If you are a stockholder of record, you can attend the Annual Meeting and vote your shares during the meeting, by going to the web address www.virtualshareholdermeeting.com/YETI2024, entering the control number on the proxy card or Notice of Internet Availability you received and following the instructions for voting.

Beneficial Owners

If you are a beneficial owner and your shares are held by a bank, broker or other nominee, you should follow the instructions provided to you by that firm. Although most banks and brokers now enable beneficial owners to submit their voting instructions by mail, by telephone and by Internet, availability and specific procedures will depend on their voting arrangements. Shares held beneficially may be voted electronically during the Annual Meeting by going to the web address www.virtualshareholdermeeting.com/YETI2024, entering the control number on the voting instruction form or Notice of Internet Availability received by the beneficial owner and following the instructions for voting.

ATTENDING THE VIRTUAL ANNUAL MEETING

Logistics

You may attend the Annual Meeting online, including to vote and/or submit questions, at www.virtualshareholdermeeting.com/YETI2024. The Annual Meeting will begin at 8:00 a.m. CDT, with online check-in beginning at 7:45 a.m. CDT, on May 7, 2024. Stockholders will need to use the control number on their proxy card, voting instruction form or Notice of Internet Availability in order to log into www.virtualshareholdermeeting.com/YETI2024. We encourage you to access the Annual Meeting prior to the start time. Please allow ample time for online check-in, which will begin at 7:45 a.m. CDT. Please note that if you do not have your control

-i-

Table of Contents

TABLE OF CONTENTS

(continued)

number and you are a registered owner, operators will be able to provide your control number to you. However, if you are a beneficial owner (and thus hold your shares in an account at a bank, broker or other holder of record), you will need to contact that bank, broker or other holder of record to obtain your control number prior to the Annual Meeting if you are unable to locate it on your voting instruction form or Notice of Internet Availability. Technicians will be available to assist you with any technical difficulties. If you encounter any difficulties accessing the Annual Meeting during the check-in or during the Annual Meeting, please call 1-844-986-0822, or 303-562-9302 for international calls. The technical support number will also be displayed on the login page of the online virtual meeting platform.

Asking Questions

You may submit live questions in writing during the Annual Meeting at www.virtualshareholdermeeting.com/YETI2024. During the Annual Meeting, we will answer as many stockholder submitted questions as time permits, and any questions that we are unable to address during the Annual Meeting will be published and answered on our website following the Annual Meeting with the exception of any questions that are irrelevant to the purpose of the Annual Meeting or our business or that contain inappropriate or derogatory comments. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition.

OUR BOARD OF DIRECTORS

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Name | Age | Class | Director Since | Current Term Expires | Committee Membership |

| | |

| | |

| Audit | Compensation | Nominating and Governance |

| | | | | | | |

| Elizabeth L. Axelrod | 61 | I | 2023 | 2025 | | n | n |

| Alison Dean | 59 | III | 2020 | 2024 | n p | | n |

| Frank D. Gibeau | 55 | I | 2020 | 2025 | n | n | |

| Robert Katz | 57 | III | 2023 | 2024 | | n | n |

| Mary Lou Kelley | 63 | II | 2019 | 2026 | n | | l |

| Dustan E. McCoy | 74 | II | 2018 | 2026 | | l | |

| Matthew J. Reintjes | 48 | I | 2016 | 2025 | | | |

Robert K. Shearer « | 72 | II | 2018 | 2026 | lp | | |

« Chair of the Board lCommittee Chair nCommittee Member p Audit Committee Financial Expert

| | | | | |

| YETI® 2024 Proxy Statement |

3 |

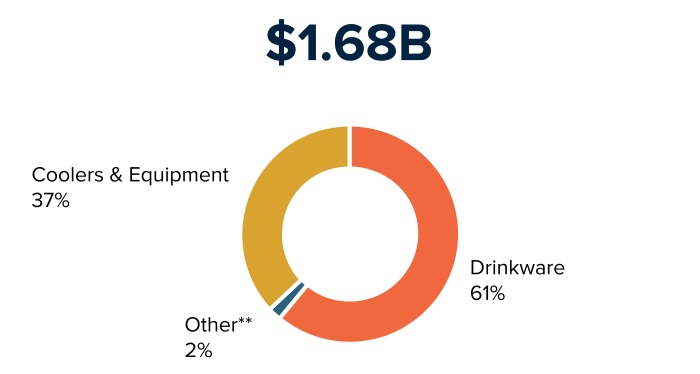

ABOUT YETI

YETI is a global designer, retailer, and distributor of innovative outdoor products. From coolers and drinkware to backpacks and bags, YETI products are built to meet the unique and varying needs of diverse outdoor pursuits, whether in the remote wilderness, at the beach, or anywhere life takes our customers. By consistently delivering high-performing, exceptional products, we have built a strong following of brand loyalists throughout the world, ranging from serious outdoor enthusiasts to individuals who simply value products of uncompromising quality and design. We have an unwavering commitment to outdoor and recreation communities, and we are relentless in our pursuit of building superior products for people to confidently enjoy life outdoors and beyond.

Headquartered in Austin, Texas, we are powered by over 1,000 full-time employees. We distribute our products through a balanced omni-channel platform, consisting of our wholesale and direct-to-consumer (“DTC”) channels.

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE

Environmental, Social, and Governance (“ESG”) matters are a vital part of YETI’s culture and brand. As a brand rooted in passion for the outdoors, we are committed to serve as responsible stewards of the planet and our communities. YETI is built on the relationships we’ve made, the unparalleled products we create, and the places we've supported and helped to protect. As a result, our ESG strategy, Keep the Wild Wild, centers on three interconnected areas, each with a set of specific goals and programs for addressing our most impactful environmental and social issues: People, Product, Places.

| | | | | |

| 4 |

YETI® 2024 Proxy Statement |

COMMUNITY REACH

2023 STRATEGIC PRIORITIES

| | | | | |

| YETI® 2024 Proxy Statement |

5 |

-ii-

Table of Contents

PROPOSAL 1. ELECTION OF

TWO CLASS

IIII DIRECTORS

Our

The Board

currently consists of eight qualified directors with skills

we believe are aligned to our business and strategy.

Currently,The table below sets forth the names of our

Board is comprisedcurrent directors, including each of

the following members: | | | | |

NAME

| | CLASS

| | YEAR TERM EXPIRES

|

|---|

| | | | |

Matthew J. Reintjes | | Class I | | 2019 |

| | | | |

Roy J. Seiders | | Class I | | 2019 |

| | | | |

Mary Lou Kelley | | Class II | | 2020 |

| | | | |

Dustan E. McCoy | | Class II | | 2020 |

| | | | |

Robert K. Shearer | | Class II | | 2020 |

| | | | |

Jeffrey A. Lipsitz | | our Class III | | 2021 |

| | | | |

Michael E. Najjar | | Class III | | 2021 |

| | | | |

David L. Schnadig | | Class III | | 2021 |

| | | | |

Director Nominees

The stockholders are being asked to elect Matthew J. Reintjes and Roy J. Seiders to serve as Class I directors for a term of three years ending at our 2022 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified. Both currently serve as Class I directors whose terms expireterm expires at the Annual Meeting. They haveMeeting and each agreed to being named in this proxy statement anddirector of YETI who will continue to serve as a Class I director if elected.after the Annual Meeting. Our Board has nominated these directors following the recommendationeach of the Nominating and Governance Committee oftwo current Class III directors for election at the Board.

Mr. Reintjes has servedAnnual Meeting as our President and Chief Executive Officer since September 2015 and as a member of our Board since March 2016. Mr. Seiders has served as a member of our Board since June 2012. Mr. Seiders is one of our Founders and served as our Chief Executive Officer from 2006 to September 2015.

further described under “Director Nominees” below.

| | | | | | | | | | | |

| Name | Class | Year Term Expires |

| Frank D. Gibeau | I | 2025 |

| Matthew J. Reintjes | I | 2025 |

| Elizabeth L. Axelrod | I | 2025 |

| Mary Lou Kelley | II | 2026 |

| Dustan E. McCoy | II | 2026 |

| Robert K. Shearer | II | 2026 |

| Alison Dean | III | 2024 |

| Robert Katz | III | 2024 |

The classified structure of

ourthe Board was adopted in our Amended and Restated Certificate of Incorporation, effective October 25, 2018 (the

"Certificate“Certificate of

Incorporation"Incorporation”).

Unless otherwise directed, the proxy holders named in the proxy you submit intend to vote "For All"

Director nominees are elected by a plurality of the nomineesvotes cast by holders of the shares of our common stock entitled to vote in the election of directors at a meeting of stockholders at which a quorum is present. This means that the two Class I directors. IfIII director nominees who receive the most affirmative votes (among votes properly cast in person or by proxy) will be elected to the Board at the Annual Meeting.

Should any

director nominee

should become unable or unwilling

for good cause to serve as a

Class I director

if elected,at the

shares will be votedtime of the Annual Meeting, the proxy holders may vote the proxies for

suchthe election of any substitute nominee

asthe Board may

be proposed by our Boardnominate or

ourdesignate, or the Board may reduce the number of directors constituting the Board. However, we are not aware of any circumstances that would prevent any of the

Class III director nominees from serving.

Directors are elected to serve until the expiration of their three-year term and until their successors have been elected and qualified. Unless otherwise directed, the proxy holders named in the proxy you submit intend to vote “For All” to elect each Class III director nominee to the Board.

| | | | | | | | |

| | |

| | The Board unanimously recommends that stockholders vote “FOR ALL” to elect each Class III director nominee to the Board. |

| |

| | | | | |

| 6 | YETI® 2024 Proxy Statement |

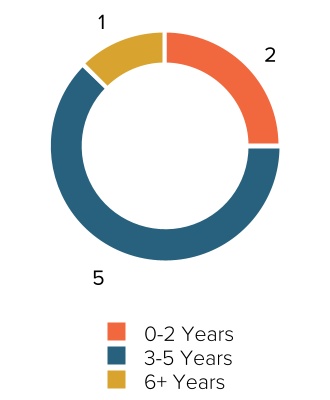

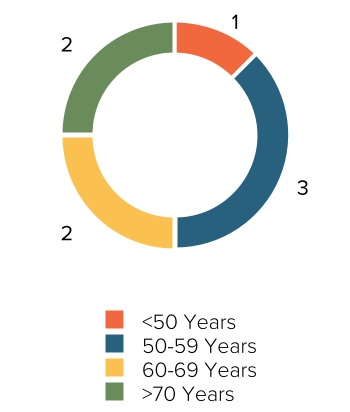

BOARD SNAPSHOT

Age Distribution

Average Age: 61

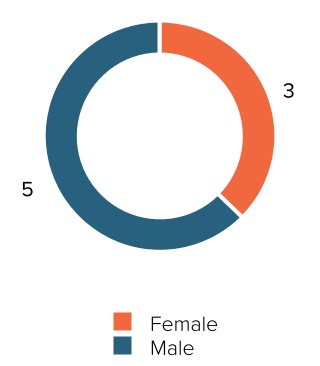

Gender Diversity

Female: 38%

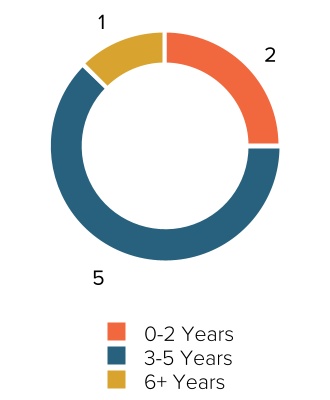

Board Tenure

Average Tenure: 3.75 Years

DIRECTOR NOMINEES

We are asking our stockholders to elect Alison Dean and Robert Katz to serve as Class III directors for a term of three years ending at our 2027 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified. Each Class III director nominee currently serves as a Class III director whose term expires at the Annual Meeting. Each Class III director nominee has consented to be named as a director nominee in this Proxy Statement and to serve as a Class III director if elected, and each Class III director nominee has expressed his or her intention to serve the entire term. The Board

unanimously recommends that stockholders vote "For All"has nominated these directors following the recommendation of the

nominees inNominating and Governance Committee of the

election of two Class I directors.- 1 -

Table of Contents

Board.

The following section providessections provide information with respect to each nominee for election as a Class III director. It includes the specific experience, qualifications, and skills considered by the Nominating and Governance Committee and the Board in assessing the appropriateness of the person to serve as a director, as well as the start of each director’s tenure on the Board, his or her age, and such director’s committee assignments. Ages are as of March 26, 2024.

| | | | | |

| YETI® 2024 Proxy Statement | 7 |

CLASS III DIRECTOR NOMINEES (FOR TERMS EXPIRING IN 2027)

| | | | | | | | |

| Alison Dean | | |

| | |

| CAREER HIGHLIGHTS •iRobot Corporation, a leading global consumer robot company ◦Executive Vice President, Chief Financial Officer, and Treasurer (April 2013 to May 2020) ◦Senior Vice President, Corporate Finance (February 2010 to April 2013) ◦Vice President, Finance (August 2005 to February 2010) •3Com Corporation, a digital electronics manufacturer ◦Several senior financial roles (1995 to August 2005), including vice president and corporate controller (2004 to 2005) and vice president of finance, worldwide sales (2003 to 2004) OTHER PUBLIC COMPANY BOARD SERVICE •Everbridge, Inc., a global software company that provides critical event management and enterprise safety applications (since July 2018) — current Chair of its Audit Committee •SmartRent, Inc., a provider of smart home and smart property solutions for the multifamily industry (since March 2024) – current member of its Audit Committee. EDUCATION •M.B.A., Boston University •B.A., Business Economics, Brown University KEY SKILLS AND QUALIFICATIONS Ms. Dean was selected to serve on our Board because of her: ◦extensive consumer business and corporate finance experience and knowledge ◦experience leading global retail consumer products expansion initiatives

|

Director Since: October 2020 |

Age: 59 |

Committees: Audit; Nominating & Governance |

Independent: Yes |

|

| | | | | | | | |

| Robert Katz | | |

| | |

| CAREER HIGHLIGHTS •Vail Resorts, Inc., a mountain resort company ◦Executive Chairperson (November 2021 to present) ◦Chairperson (March 2009 to November 2021) ◦Chief Executive Officer (February 2006 to November 2021) •Apollo Management L.P., a private equity investment firm ◦Various roles (1990-2006) OTHER PUBLIC COMPANY BOARD SERVICE •Vail Resorts, Inc. (since 1996) EDUCATION •B.S., Economics, University of Pennsylvania Wharton School KEY SKILLS AND QUALIFICATIONS Mr. Katz was selected to serve on our Board because of his: ◦senior leadership experience at an outdoor sports and recreation company ◦deep knowledge of corporate strategy, development and global branding |

Director Since: December 2023 |

Age: 57 |

Committees: Compensation; Nominating & Governance |

Independent: Yes |

| | | | | |

| 8 | YETI® 2024 Proxy Statement |

DIRECTORS CONTINUING IN OFFICE

The following section provides information with respect to each director of YETI who will continue to serve as a director after the Annual Meeting. It includes the specific experience, qualifications, and skills considered by the Nominating and Governance Committee

and/orand the Board in assessing the appropriateness of the person to serve as a director, as well as the start of each

director'sdirector’s tenure on

ourthe Board,

their ageshis or her age, and

such director’s committee assignments. Ages are as of

April 4, 2019. ClassMarch 26, 2024.

CLASS I Nominees

DIRECTORS (FOR TERMS EXPIRING IN 2025)

| | | | | | | | | | | |

| Elizabeth L. Axelrod | |

| | | |

| CAREER HIGHLIGHTS •Airbnb, Inc., a vacation rental online marketplace company ◦Global Head of Employee Experience (2017 to 2021) •eBay Inc., an e-commerce company ◦Senior Vice President, Human Resources (2005-2015) OTHER PUBLIC COMPANY BOARD SERVICE •Heidrick & Struggles International, Inc., an international executive search, management and leadership consulting firm (since 2016) — current Chair of its Human Resources and Compensation Committee and member of its Nominating and Board Governance Committee EDUCATION •M.P.P.M., Yale University •B.S., Economics, University of Pennsylvania Wharton School KEY SKILLS AND QUALIFICATIONS Ms. Axelrod was selected to serve on our Board because of her: ◦extensive human resources and talent management experience ◦deep understanding of global businesses and e-commerce |

Director Since: December 2023 |

Age: 61 |

Committees: Compensation; Nominating & Governance |

Independent: Yes |

|

| | | | | |

| YETI® 2024 Proxy Statement | 9 |

| | | | | | | | | | | |

| Frank D. Gibeau | |

| | | |

| KEY SKILLS AND QUALIFICATIONS •Take Two Interactive Software, Inc., a leading developer of interactive entertainment ◦President, Zynga Label (July 2022 to present) •Zynga Inc., a leading provider of social game services ◦Chief Executive Officer (March 2016 to July 2022) •Electronic Arts Inc., a global leader in digital interactive entertainment ◦Executive Vice President of EA Mobile (September 2013 to May 2015) ◦President of EA Labels (August 2011 to September 2013) ◦President of EA Games Label (June 2007 to August 2011) ◦Executive Vice President, General Manager, North America Publishing (September 2005 to June 2007) ◦Senior Vice President of North American Marketing (2002 to September 2005) OTHER PUBLIC COMPANY BOARD SERVICE •Zynga (August 2015 to July 2022) EDUCATION •M.B.A., Santa Clara University •B.S., Business Administration, University of Southern California KEY SKILLS AND QUALIFICATIONS Mr. Gibeau was selected to serve on our Board because of his: •extensive leadership experience in a public company •extensive public accounting, finance, and internal control experience •deep knowledge of corporate strategy, product development and brand building |

MATTHEWDirector Since: February 2020

|

Age: 55 |

Committees: Audit; Compensation |

Independent: Yes |

|

| | | | | |

| 10 | YETI® 2024 Proxy Statement |

| | | | | | | | | | | |

Matthew J. REINTJES

Director since 2016

Age: 43Reintjes | |

| | | |

| Qualifications:Mr. Reintjes has served as our

CAREER HIGHLIGHTS •YETI Holdings, Inc. ◦President and Chief Executive Officer since September 2015 and was appointed to our Board in March 2016. Prior to joining us, Mr. Reintjes served from February(September 2015 to September 2015 as Vice President of the Outdoor Products reporting segment at Present) •Vista Outdoor Inc., a manufacturer of outdoor sports and recreation products, which, prior to February 9, 2015, was operated as a reporting segment of Alliant Techsystems Inc. ("ATK") ◦Vice President of Outdoor Products (February 2015 to September 2015) •Alliant Techsystems Inc., an aerospace, defense, and sporting goods company. While at ATK, Mr. Reintjes served as company ◦Vice President of Accessories from November(November 2013 to February 2015. Prior to ATK, Mr. Reintjes served as Chief Operating Officer of 2015) •Bushnell Holdings Inc., a portfolio of leading brands in outdoor and recreation products from May 2013 until its acquisition by ATK in November 2013. Mr. Reintjes also served as ◦Chief Operating Officer of (May 2013 to November 2013) •Hi-Tech Industrial Services, Inc., a supplier of industrial services from January ◦Chief Operating Officer (January 2013 to May 2013. Prior to this time, Mr. Reintjes served for nine years in a variety of general management roles at 2013) •Danaher Corporation, a global science and technology company including: ◦President of KaVo Equipment Group—NorthGroup-North America from October(October 2011 to January 2013; President—Imaging from April2013) ◦President-Imaging (April 2011 to October 2011; and roles2011) ◦Roles including Vice President/General Manager, Vice President of Sales, and Senior Product Manager of Danaher Corporation from 2004(2004 to October 2011. Mr. Reintjes holds a 2011) EDUCATION •M.B.A., University of Virginia’s Darden School of Business •B.A. in, Economics, from the University of Notre Dame and an M.B.A. from the University of Virginia's Darden School of Business. |

|

|

KEY SKILLS AND QUALIFICATIONS Mr. Reintjes was selected to serve on our Board because of his his: •perspective and experience as our President and Chief Executive Officer and his CEO •extensive experience in corporate strategy, brand leadership, new product development, general management processes and •operations leadership with companies in the outdoor sports and recreation products industries.industries |

| | Director Since: March 2016 |

ROY J. SEIDERS

Director since 2012

Age: 42

| | Qualifications:

Mr. Seiders has served as a member of our Board since June 2012. From 2006 to September 2015, Mr. Seiders served as our Chief Executive Officer. Mr. Seiders is one of our Founders and has been consistently focused on product design and development, as well as developing our marketing tone. Since September 2015, Mr. Seiders has served as the Chairman and Founder of our wholly owned subsidiary, YETI Coolers, LLC. Mr. Seiders holds a B.A. from Texas Tech University.

48 |

|

|

Mr. Seiders was selected to serve on our Board because of his unique perspective and experience as one of our Founders and leaders since our inception and because of his passion for, and extensive knowledge of, our products, brand, Ambassadors, and customers. |

|

|

| | | | | |

| YETI® 2024 Proxy Statement | | 11 |

- 2 -

Table of Contents

Class II Directors

| | | | | |

MARY LOU KELLEY

Director since 2019

Age: 58

Compensation Committee

Our Board of Directors | |

CLASS II DIRECTORS (FOR TERMS EXPIRING IN 2026)

| | | | | | | | | | | |

| Mary Lou Kelley | | Qualifications:Ms. Kelley has served as a member of our Board since February 2019. From April 2014 through March 2017, Ms. Kelley served as President, E-Commerce for

| | | |

| CAREER HIGHLIGHTS •Best Buy Co., Inc., a consumer electronics retailer. Priorretailer ◦President, E-commerce (April 2014 to joining Best Buy, she served as Senior Vice President, E-Commerce for Chico'sMarch 2017) •Chico’s FAS Inc., a retail women'swomen’s clothing chain from July ◦Senior Vice President, E-commerce (July 2010 to March 2014. Previously, Ms. Kelley held the posts of 2014) •L.L. Bean, a retail company ◦Vice President of Retail Real Estate and Marketing and Vice President of E-Commerce for L.L. Bean, a retail company. Ms. Kelley has served on the board of directors of (2006 to 2009) OTHER PUBLIC COMPANY BOARD SERVICE •Vera Bradley, Inc., a luggage and handbag design company since(since December 2015 and on the board of directors of 2015) •Finning International, Inc., a dealer of construction machinery and equipment since(since January 2018. Ms. Kelley holds a B.A. in Economics from Boston College and an 2018) EDUCATION •M.B.A. from the, University of Virginia'sVirginia’s Darden School of Business. |

|

|

Business•B.A., Economics, Boston College KEY SKILLS AND QUALIFICATIONS Ms. Kelley was selected to serve on our Board because of her her: •extensive executive leadership experience and •deep knowledge of consumer products, e-commerce, and omni-channel marketing.marketing •knowledge of corporate compensation and governance matters |

| | Director Since: February 2019 |

DUSTANAge: 63

|

Committees: Audit; Nominating & Governance (Chair) |

Independent: Yes |

|

| | | | | | | | | | | |

Dustan E. MCCOY

Director since 2018

Age: 69

Audit Committee

Compensation Committee

(Chair)McCoy | |

| | | |

| Qualifications:

Mr. McCoy has served as a member of our Board since October 2018. Since 2006, Mr. McCoy has served on the board of directors of Freeport-McMoRan Inc., a mining company, where he currently chairs its compensation committee. In addition, since 2002, he has served on the board of directors of Louisiana-Pacific Corporation, a building materials manufacturer, where he currently chairs its compensation committee. From 2005 to 2016, Mr. McCoy was Chairman of the Board and Chief Executive Officer of

CAREER HIGHLIGHTS •Brunswick Corporation, a global manufacturer and marketer of recreation products ◦Chairman of the Board and served in various other roles atChief Executive Officer (December 2005 to February 2016) ◦President, Brunswick Corporation fromBoat Group (October 2000 to December 2005) ◦Vice President, General Counsel and Corporate Secretary (September 1999 to 2005. Prior to joining Brunswick Corporation, Mr. McCoy served as Executive Vice President for October 2000) •Witco Corporation, a specialty chemical products company and also served Witco Corporation as ◦Executive Vice President ◦Senior Vice President, General Counsel and Corporate Secretary. Mr. McCoy holdsSecretary OTHER PUBLIC COMPANY BOARD SERVICE •Freeport-McMoRan Inc., a B.A. in Political Science from Eastern Kentucky Universitymining company (since 2006) — current member of its Compensation Committee and Lead Independent Director •Louisiana-Pacific Corporation, a building materials manufacturer (since 2002) — current member of its Compensation Committee and Lead Independent Director EDUCATION •J.D. from, Salmon P. Chase College of Law, at Northern Kentucky University. |

|

|

University•B.A., Political Science, Eastern Kentucky University KEY SKILLS AND QUALIFICATIONS Mr. McCoy was selected to serve on our Board because of his his: •extensive leadership experience and •broad understanding of global businesses and his •knowledge of corporate compensation, legal, compliance, governance and disclosure matters.matters |

Director Since: October 2018 |

Age: 74 |

Committees: Compensation (Chair) |

Independent: Yes |

|

| | | | | |

| 12 | | YETI® 2024 Proxy Statement |

- 3 -

Table of Contents

Class II Directors (cont.)

| | | | | |

| ROBERT

Our Board of Directors |

| | | | | | | | | | | |

Robert K. SHEARER

Director since 2018

Age: 67

Audit Committee (Chair)

Nominating and Governance CommitteeShearer (Chair of the Board) | |

| | | |

| Qualifications:Mr. Shearer has served as a member of our Board since October 2018. From 2005 to 2015, Mr. Shearer served as Senior Vice President and Chief Financial Officer of

CAREER HIGHLIGHTS •VF Corporation, a global lifestyle and apparel company ◦Senior Vice President and from 1986Chief Financial Officer (May 2005 to 2005, served in various other roles at VF Corporation, including March 2015) ◦Vice President—President — Finance and Chief Financial Officer (January 2003 to May 2005) ◦Vice President and Vice President—Controller. ForController (June 2000 to January 2003) ◦Various senior leadership positions, including two years he wasas President of VF Corporation'sCorporation’s Outdoor Coalition, which was formed with the acquisition of The North Face brand. Priorbrand (1986 to joining VF Corporation, Mr. Shearer was a Senior Audit Manager for 2002) •Ernst & Young LLP, a multinational professional services firm. Since 2008, Mr. Shearer has served on the board of directors of firm ◦Senior Audit Manager OTHER PUBLIC COMPANY BOARD SERVICE •Church & Dwight Co.,Co, Inc., a household products manufacturer where he currently chairs the audit committee. He previously served on the board(since 2008) — current member of directors of The Fresh Market,its Audit Committee •Kontoor Brands Inc., a specialty grocery chain. Mr. Shearer holds a global lifestyle apparel company (since May 2019) — current Lead Director of the Board and Chair of its Audit Committee EDUCATION •B.S. in, Accounting, from Catawba College. |

|

|

CollegeKEY SKILLS AND QUALIFICATIONS Mr. Shearer was selected to serve on our Board due to his because of his: •extensive public accounting, finance, and internal control experience as well as his •experience in leading global retail consumer products expansion initiatives.initiatives •knowledge of corporate disclosure matters •broad understanding of global businesses •experience in investor relations and communications |

Director Since: October 2018 |

Age: 72 |

Committees: Audit (Chair) |

Independent: Yes |

|

BOARD COMPOSITION, QUALIFICATIONS, AND DIVERSITY

Consistent with YETI’s Corporate Governance Guidelines and Nominating Policy (which is attached to the Nominating and Governance Committee Charter), the Board desires a diverse group of candidates who possess the background, skills, expertise, and time to make a significant contribution to the Board, YETI, and its stockholders and who will expand or complement the Board’s existing expertise. YETI believes that diversity in gender, race/ethnicity, skills and backgrounds ensures that the widest range of options and viewpoints are expressed in the boardroom.

The Nominating and Governance Committee makes recommendations to the Board concerning the composition of the Board and its committees, including size and qualifications for membership. The Nominating and Governance Committee evaluates prospective nominees against the standards and qualifications set forth in YETI’s Corporate Governance Guidelines and Nominating Policy as well as other relevant factors it deems appropriate.

As with our employees, cultivating a diverse board is critical to YETI’s success. The Board believes that diversity is one of many important considerations in board composition. Directors with different backgrounds and skills help build diversity on the Board and maximize group dynamics in terms of function, experience, education, and thought. In addition, YETI believes its stockholders will appreciate a diverse board, which is reflective of the overall investment community and the markets we serve and communities in which our customers reside. The Nominating and Governance Committee evaluates the composition of the Board at least annually to ensure that the Board’s membership reflects a diversity of viewpoints, and will generally consider each nominee’s professional experience, background, education, financial expertise, gender, race/ethnicity, age, and other individual qualities and attributes against the backdrop of the Board’s existing composition. The Nominating and Governance Committee is committed to the recruitment of highly qualified women, racially/ethnically diverse individuals, and other candidates with diverse backgrounds, experiences, and skills. In support of this commitment, the Nominating and Governance Committee includes, and instructs any

| | | | | |

| YETI® 2024 Proxy Statement | | 13 |

Class III Directors

| | | | | |

JEFFREY A. LIPSITZ

Director since 2018

Age: 53

Our Board of Directors | |

search firm it engages to include, qualified women and individuals from underrepresented communities in the pool from which the committee selects potential non-incumbent director candidates. Our Board’s current composition demonstrates this commitment as we currently have three women on our Board, comprising approximately 38% of the Board.

Below are certain skills and experience that the Board considers important for our directors to have in light of our current business and structure. The director nominees’ biographies above include information pertaining to each nominee’s relevant experience relative to these attributes.

Accounting & Finance

We place high importance on financial discipline, accurate financial reporting and robust financial controls and compliance, and value directors with an understanding of accounting and financial reporting processes, including an understanding of GAAP and/or internal controls.

Business Development/M&A/Strategy

We will continue investing in our business, the brand, and innovation. We value directors who can provide insight into opportunities that support such investment, including experience developing and implementing strategic direction and growth, managing growth operations and completing and integrating mergers and acquisitions.

Compliance/Corporate Governance/Legal/Risk Management

Familiarity with corporate governance and legal matters enables directors to effectively oversee compliance with legal and regulatory requirements. In addition, experience assessing and managing risks enables directors to effectively oversee and mitigate the most significant risks facing YETI.

E-Commerce/Consumer Products

Part of our growth strategy involves increasing sales through our DTC e-commerce channel, which makes directors with experience in e-commerce and consumer products valuable.

Senior Leadership Experience

Directors who have served as CEOs or in other senior leadership positions bring experience and perspective in analyzing, shaping, and overseeing the execution of important operational and policy issues at a senior level.

Global Business Expertise

Because we are expanding internationally and becoming a global organization, directors with global expertise, including experience managing or overseeing global operations that require an understanding of cultural, political, or regulatory requirements, can provide useful business and cultural perspectives regarding many significant aspects of our business.

Marketing/Brand Development

The YETI name and premium brand image are integral to the growth of our business, as well as to the implementation of our strategies for expanding our business. Directors with marketing or brand development experience provide critical insights to our Board.

Outdoor Sports Industry

The Board believes that outdoor and recreation products industry experience and extensive knowledge of YETI’s products are valuable in shaping and enhancing our growth strategy.

Public Company Board Experience

Directors who have served or serve on other public company boards can offer advice and insights with regard to the dynamics and operation of a board of directors, the relationship between a board and the CEO and other management personnel, the importance of particular agenda items and oversight of a changing mix of strategic, operational and compliance matters.

Talent/Organizational Development

Human resources and talent management experience assists our Board in overseeing executive compensation, succession planning, and employee engagement.

| Qualifications:Mr. Lipsitz has served as a member of our Board since October 2018. Mr. Lipsitz is a Managing Partner of Cortec Group Fund V, L.P. (together with its affiliates, "Cortec"), an investment fund owned by a private equity firm and our principal stockholder since its initial investment in 2012. Mr. Lipsitz joined Cortec in 1998, oversees a number of portfolio companies and initiated and leads the firm's acquisition activities with regard to healthcare investments. Prior to joining Cortec, Mr. Lipsitz was Vice President of Corporate Development and had oversight responsibility for the distribution businesses of PLY Gem Industries, Inc., a manufacturer of exterior building products. Mr. Lipsitz holds a B.A. from Union College and an M.B.A. from the Columbia University Graduate School of Business.

| | | | |

14 |

|

Mr. Lipsitz was selected to serve on our Board because of his extensive knowledge and understanding of our business and his strategic planning, financial analysis, mergers and acquisitions, and operating performance experience. |

| | YETI® 2024 Proxy Statement |

- 4 -

Table of Contents

Class III Directors (cont.)

Board Skills Matrix

The following matrix summarizes the key knowledge, skills and experience that qualifies each director for our Board.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Axelrod | Dean | Gibeau | Katz | Kelley | McCoy | Reintjes | Shearer |

MICHAEL E. NAJJAR

Director since 2012

Age: 52

Audit Committee

Nominating and Governance

Committee

| | Qualifications:Mr. Najjar has served as a member of our Board since June 2012. Mr. Najjar is a Managing Partner of Cortec. Mr. Najjar joined Cortec in 2004, oversees several Cortec portfolio companies, and leads transaction sourcing efforts. Prior to Cortec, Mr. Najjar was a Managing Director at Cornerstone Equity Investors, a private equity firm. Prior to Cornerstone Equity Investors, Mr. Najjar was an investment banker at Donaldson, LufkinExperience & Jenrette, an investment bank. Mr. Najjar holds a B.A. from Cornell University and an M.B.A. from The Wharton School at the University of Pennsylvania.

Strategic Competencies |

Accounting & Finance

(Reporting, Auditing, Internal Controls) | |

P |

Mr. Najjar was selected to serve on our Board because of his extensive knowledge and understanding of our business, consumer businesses, corporate finance, and treasury.P | P | | P | | P |

Business Development/M&A/Strategy | P | P | P | P | P | P | P | P |

DAVID L. SCHNADIG

Chair of the Board

Director since 2012

Age: 54

Compensation Committee

Nominating and Governance

Committee (Chair)

Compliance/Corporate Governance/ Legal/ Risk Management | | | P | | Qualifications:

Mr. Schnadig has served as the Chair of our Board since June 2012. Mr. Schnadig is a Managing Partner of Cortec. Mr. Schnadig joined Cortec in 1995, oversees a number of Cortec portfolio companies and leads the firm's acquisition activities with regard to consumer and business-to-business products and specialty services companies. Prior to joining Cortec, Mr. Schnadig was Assistant to the Chairman of SunAmerica Inc., a life insurance and financial services company. Prior to SunAmerica Inc., Mr. Schnadig was an investment banker at Lehman Brothers, Inc., a global financial services firm, and a management consultant at Cresap, McCormick & Paget, general management consultants. Mr. Schnadig holds a B.A. from Trinity College and an M.B.A. from the Kellogg School of Management at Northwestern University.

| P | | P |

E-commerce; Consumer Products |

P |

Mr. Schnadig was selected to serve on our Board because of his extensive knowledge and understanding of our business, consumer products businesses, corporate strategy, corporate finance, and governance.P | P | | P | P | P | P |

Global Business | P | P | P | P | P | P | P | P |

| Marketing/Brand Development | | | P | P | P | P | P | |

| Outdoor Sports Industry | | | | P | | P | P | P |

| Public Company Board | P | P | P | P | P | P | P | P |

| Senior Leadership | P | P | P | P | P | P | P | P |

| Talent/Organizational Development | P | | P | P | P | P | P | |

| Diversity |

| Gender | F | F | M | M | F | M | M | M |

| Race/Ethnicity: White/Caucasian | P | P | P | P | P | P | P | P |

| Veteran | | | | | | P | | |

| | | | | |

| YETI® 2024 Proxy Statement | 15 |

CORPORATE GOVERNANCE

YETI and the Board believe that sound corporate governance is a source of competitive advantage for YETI and allows the skills, experience, and judgment of the Board to support our executive management team, enabling management to improve our performance and maximize stockholder value. Our businessstrong corporate governance practices, including those highlighted below, are reflected in our Corporate Governance Guidelines and affairs are managed underother key governance documents, which set the direction offramework for our Board. Our Board currently consists of eight directors, comprisinggovernance structure.

YETI’s Corporate Governance Guidelines, along with our

Chief Executive Officer, one of our Founders, three outside directors, and three Managing Partners of Cortec, our principal stockholder.Ourother principal governance documents, are available under "Governance"“Governance” in the Investor Relations section of our website, www.YETI.com.

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE

Our CEO reviews and approves YETI’s overall ESG strategy at the executive level, with key insight and support from all members of our senior leadership team. Our ESG team comprises ESG leaders embedded within the organization, including

our:•Corporate Governance Guidelines

•Codeour ESG Reporting Lead (reporting through our Vice President, Compliance to our Chief Legal Officer), our DE&I Lead (reporting to our Chief Human Resources Officer), and our Sustainability Lead (reporting to Senior Vice President, Supply Chain & Operations). The ESG team is responsible for setting our enterprise-wide ESG strategy, managing ESG topics, driving multi-year goals, and establishing cross-functional working groups, as needed. Our Board is responsible for the oversight of Ethicsour ESG strategy. Specific material ESG topics are addressed by different committees of our Board. The Board receives updates on our ESG strategy at least annually. YETI has established an enterprise risk framework for identifying, aggregating, and Business Conduct

•Audit Committee Charter

•Compensation Committee Charter

•Nominatingevaluating risk across the enterprise, including ESG topics. To remain focused on the most material ESG topics, the risk framework is integrated with our annual planning, audit scoping, and Governance Committee Charter

- 5 -

Table of Contents

Controlled Company Exemption

Pursuantcontrol evaluation management process, which are performed by our internal audit team. In June 2023, we published our third annual report on our commitment to a voting agreement by and among Cortec, Roy J. Seiders, Ryan R. Seiders and their respective affiliates (the "Voting Agreement"), byESG topics, which Cortec has the right to voteis available in the electionSustainability, Diversity & Community section of our directors the shares of common stock heldwebsite, www.YETI.com. Our ESG reporting and disclosure is guided by all parties to the Voting Agreement, Cortec controlsleading industry frameworks including GRI and SASB. For more than 50% of the total voting power of our common stock with respect to the election of our directors. As a result, we are a "controlled company" under the New York Stock Exchange ("NYSE") listing standards. As a controlled company, we are exempt from certain NYSE corporate governance requirements, including the requirements (a) that a majority of our Board consist of independent directors, as defined under the NYSE listing standards, (b) that our Nominatinginformation regarding YETI’s ESG strategy, goals, and Governance Committee be composed entirely of independent directors, and (c) that our Compensation Committee be composed entirely of independent directors. We are currently relying on these exemptions and expect to continue to do so. In the event that we cease to be a controlled company and our shares continue to be listed on the NYSE, we will be required to comply with these provisions within applicable transition periods.

Director Independence

initiatives, please visit www.YETI.com/ESG.

DIRECTOR INDEPENDENCE

Currently, our Board consists of eight members,

threeseven of whom are independent.

See "—Controlled Company Exemption" above for additional information regarding our status as a controlled company and reliance on the controlled company exemption.For a director to be considered independent in accordance with applicable New York Stock Exchange (“NYSE”) listing standards, the Board must determine that the director does not have any direct or indirect material relationship with us. The Boardus (including as a partner, shareholder or officer of an organization that has adopted the independence standards of thea relationship with us). As required by applicable NYSE listing standards, for determining director independence. Based on these independence standards, ourthe Board has affirmatively determined that each of Elizabeth L. Axelrod, Alison Dean, Frank D. Gibeau, Robert Katz, Mary Lou Kelley, Dustan E. McCoy, and Robert K. Shearer is independent under the NYSE listing standards and free of any material relationships with YETI other than as established through his or her service as a director of YETI.

The Board also previously affirmatively determined that Tracey D. Brown, who served on the Board until her resignation effective May 4, 2023, qualified as an independent director under applicable NYSE listing standards during the period of her service in 2023.

In determining director independence,

ourthe Board considers any transactions or relationships between a director and his or her immediate family and affiliates, on the one hand, and YETI and its management, on the other hand, to determine whether any such transactions or relationships are inconsistent with a determination that the director is independent. In

our reviewconnection with the Board’s assessment of

Ms.the independence of Mses. Axelrod, Dean and Kelley and Messrs.

Gibeau, Katz, McCoy,

Shearer, and

Shearer,Ms. Brown during the period of her service in 2023, we found no such transactions or relationships.

| | | | | |

| 16 | YETI® 2024 Proxy Statement |

BOARD SIZE AND COMPOSITION

The number of directors comprising the Board

Function, Leadership Structure,is fixed from time to time by resolution of the Board pursuant to the Certificate of Incorporation. The Board has determined that eight directors, seven of whom are independent, is currently the appropriate size for YETI. The Board recognizes that one of its key responsibilities is to evaluate and

Executive SessionsOurdetermine its optimal governance structure so as to provide independent oversight of management. Given the evolving nature of our business, the Board oversees the performance of YETI's Chief Executive Officer and other senior management of YETI and works to assure the best interests of stockholders are served.

Our Board does not have a policy requiring eitherhas determined that the positionsright governance structure for the Board may vary as circumstances warrant. Consistent with this understanding, the directors consider the Board’s size and composition on an annual basis in connection with its annual self-evaluation.

THE BOARD AND ITS COMMITTEES

In 2023, the Board held 4 meetings. Directors are expected to attend all Board meetings, meetings of committees on which they serve, and the Company’s annual meeting of stockholders. More to the point, directors are expected to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities. Each director attended more than 75% of the Chairaggregate of the meetings of the Board and Chief Executive Officer should be separate or that they should be occupied by the same individual. Our Board believes that this issue is properly addressed as part of the succession planning process and that it is in the best interests of YETI for the Board to make a determination on these matters when it elects a new Chief Executive Officer or Chairmeetings held by all committees of the Board or at other times consideration is warrantedon which such director served during the 2023 fiscal year. All directors then in office attended our 2023 Annual Meeting of Stockholders.

The Board currently has, and appoints the members of, three standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee. The principal responsibilities of each of these committees are described generally below and in detail in their respective committee charters, which have been approved by the

circumstances. Currently,Board and are available under “Governance” in the

roles are separate, with Mr. Reintjes serving asInvestor Relations section of our

Chief Executive Officer and Mr. Schnadig serving as Chairwebsite, www.YETI.com.The current members of the

Board.Ourcommittees are identified below.

| | | | | | | | | | | |

| Audit Committee | | The primary responsibilities of the Audit Committee are to: •assist the Board in fulfilling its oversight responsibilities with respect to (i) the integrity of YETI’s financial statements, (ii) YETI’s compliance with legal and regulatory requirements, (iii) the independent registered public accounting firm’s qualifications, independence and performance, and (iv) the performance of YETI’s internal audit function; •prepare the Audit Committee’s annual report included in this Proxy Statement; •advise and consult with management and the Board regarding the financial affairs of YETI; •appoint, compensate, retain, dismiss and oversee the work of YETI’s independent registered public accounting firm; •oversee the Company’s enterprise risk management process; •discuss with management material legal matters; and •review material conflicts of interest and review for approval any related party transactions. All members of the Audit Committee have been determined to be financially literate and to meet the applicable NYSE and SEC standards for Audit Committee independence. The Board has determined that each of Mr. Shearer and Ms. Dean qualifies as an “audit committee financial expert” within the definition established by the SEC. |

| Current Members: Mr. Shearer (Chair) Ms. Dean Mr. Gibeau Ms. Kelley |

| Number of Meetings in FY 2023: 6 |

| | |

| | | | | |

| YETI® 2024 Proxy Statement | 17 |

| | | | | | | | | | | |

| Compensation Committee | | The primary responsibilities of the Compensation Committee are to: •establish and administer YETI’s policies, programs and procedures for compensating and providing benefits to its executive officers; •make recommendations to the Board regarding the compensation of non-employee directors; •review and approve corporate goals and objectives relevant to the CEO’s compensation; •evaluate the CEO’s performance in light of these goals and objectives and, either as a committee, or together with the independent directors (as directed by the Board), determine and approve the CEO’s compensation level based on this evaluation; •review and approve corporate goals and objectives relevant to the other executive officers’ compensation, evaluate the other executive officers’ performance in light of these goals and objectives, and determine and approve the compensation level of each other executive officer based on this evaluation; •prepare the Compensation Committee’s report included in this Proxy Statement; and •make recommendations to the Board with respect to incentive-compensation plans and equity- based plans. In performing its responsibilities, the Compensation Committee takes into account the recommendations of the CEO and the Chief Human Resources Officer in determining the compensation of executive officers other than with respect to the CEO. Otherwise, our executive officers do not have any role in determining the form or amount of compensation paid to our executive officers. The Compensation Committee has retained Frederic W. Cook & Co., Inc. (“FW Cook”) as its independent compensation consultant. During the fiscal year ended December 30, 2023 (“fiscal 2023”), FW Cook advised on and assisted with the review and evaluation of executive compensation and compensation of our non-employee directors. During fiscal 2023, FW Cook provided no services to YETI other than consulting services to the Compensation Committee regarding executive and non-employee director compensation. The Compensation Committee has reviewed the independence of FW Cook under the specific independence factors adopted by the SEC and NYSE and determined that FW Cook’s work does not raise any conflicts of interest. All members of the Compensation Committee have been determined to meet the applicable NYSE and SEC standards for Compensation Committee independence. |

| Current Members: Mr. McCoy (Chair) Ms. Axelrod Mr. Gibeau Mr. Katz |

| Number of Meetings in FY 2023: 4 |

| | |

| | | | | |

| 18 | YETI® 2024 Proxy Statement |

| | | | | | | | | | | |

| Nominating and Governance Committee | | The primary responsibilities of the Nominating and Governance Committee are to: •identify individuals qualified to become members of the Board; •recommend candidates to fill Board vacancies and newly-created director positions; •recommend whether incumbent directors should be nominated for re-election to the Board upon the expiration of their terms; •recommend corporate governance guidelines applicable to the Board and YETI’s employees; •oversee the evaluation of the Board and its committees; •assess and recommend Board members to the Board for committee membership; •assist the Board with management succession planning; and •oversee the Company’s engagement with stockholders on corporate governance and other relevant matters. For an overview of the Nominating and Governance Committee’s process for evaluating and selecting potential board candidates, see “— Director Nomination Process” below. |

| Current Members: Ms. Kelley (Chair) Ms. Axelrod Ms. Dean Mr. Katz |

| Number of Meetings in FY 2023: 4 |

| | |

DIRECTOR NOMINATION PROCESS

YETI’s Nominating Policy, which describes the process for evaluating and selecting potential director candidates, is

ledadministered by the

Chair of the Board, Mr. Schnadig. The Chair of the Board oversees planning of the annual Board calendar and, in consultation with the other directors, schedules and sets the agenda for meetings of the Board. In addition, the Chair of the Board provides guidance and oversight to members of management and acts as the Board's liaison to management. In this capacity, the Chair of the Board will be actively engaged in significant matters affecting YETI.- 6 -

Table of Contents

Pursuant to the terms of a stockholders agreement, dated October 24, 2018, by and among YETI, Cortec and certain other stockholders (the "Stockholders Agreement"), so long as Cortec beneficially owns 20% or more of the outstanding shares of our common stock, YETI will take all necessary action to cause a director nominated by Cortec to serve as Chair of the Board. See "—Board Size and Composition" below for additional information regarding the Stockholders Agreement.